AI PPT Maker

Templates

PPT Bundles

Design Services

Business PPTs

Business Plan

Management

Strategy

Introduction PPT

Roadmap

Self Introduction

Timelines

Process

Marketing

Agenda

Technology

Medical

Startup Business Plan

Cyber Security

Dashboards

SWOT

Proposals

Education

Pitch Deck

Digital Marketing

KPIs

Project Management

Product Management

Artificial Intelligence

Target Market

Communication

Supply Chain

Google Slides

Research Services

One Pagers

One PagersAll Categories

Estimating company value PowerPoint Presentation Templates and Google Slides

4 Item(s)

Slide 1 of 2

This slide shows the estimated future trends in revenue of HCL Plus Logistic Company after the implementation of Logistic Technologies and Automation Softwares. The graph shows an increase in revenue of HCL Plus Company in the coming future. Deliver and pitch your topic in the best possible manner with this generating logistics value business estimated future revenue of hcl plus company after adopting ideas pdf. Use them to share invaluable insights on estimated future revenue of hcl plus company after adopting latest logistic technologies and impress your audience. This template can be altered and modified as per your expectations. So, grab it now.

Slide 1 of 10

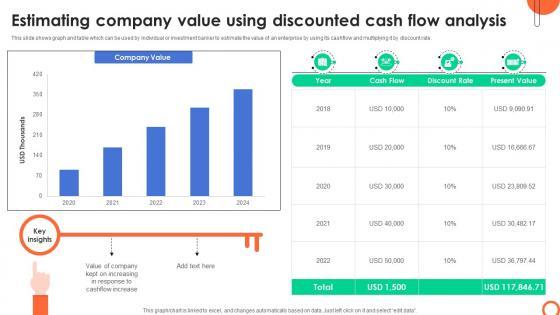

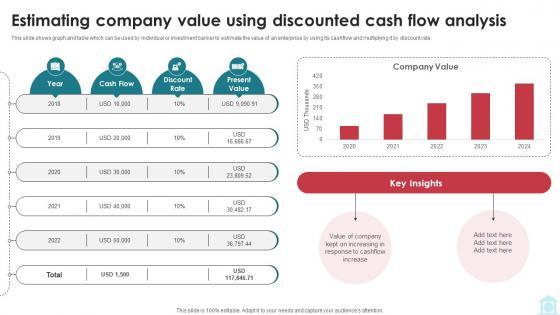

This slide shows graph and table which can be used by individual or investment banker to estimate the value of an enterprise by using its cashflow and multiplying it by discount rate. Coming up with a presentation necessitates that the majority of the effort goes into the content and the message you intend to convey. The visuals of a PowerPoint presentation can only be effective if it supplements and supports the story that is being told. Keeping this in mind our experts created Estimating Company Value Using Discounted Understanding Investment Banking Framework Fin SS V to reduce the time that goes into designing the presentation. This way, you can concentrate on the message while our designers take care of providing you with the right template for the situation. This slide shows graph and table which can be used by individual or investment banker to estimate the value of an enterprise by using its cashflow and multiplying it by discount rate.

Slide 1 of 10

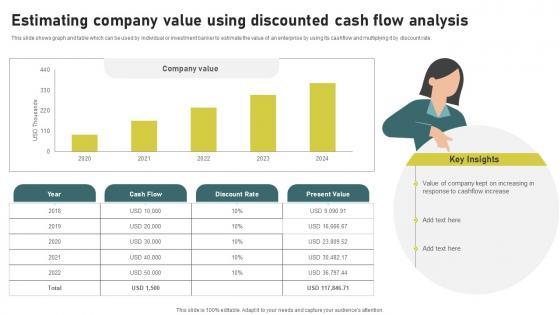

This slide shows graph and table which can be used by individual or investment banker to estimate the value of an enterprise by using its cashflow and multiplying it by discount rate. Coming up with a presentation necessitates that the majority of the effort goes into the content and the message you intend to convey. The visuals of a PowerPoint presentation can only be effective if it supplements and supports the story that is being told. Keeping this in mind our experts created Estimating Company Value Using Investment Banking Simplified Functions Fin SS V to reduce the time that goes into designing the presentation. This way, you can concentrate on the message while our designers take care of providing you with the right template for the situation. This slide shows graph and table which can be used by individual or investment banker to estimate the value of an enterprise by using its cashflow and multiplying it by discount rate.

Slide 1 of 10

This slide shows graph and table which can be used by individual or investment banker to estimate the value of an enterprise by using its cashflow and multiplying it by discount rate. Coming up with a presentation necessitates that the majority of the effort goes into the content and the message you intend to convey. The visuals of a PowerPoint presentation can only be effective if it supplements and supports the story that is being told. Keeping this in mind our experts created Estimating Company Value Using Discounted Cash Mastering Investment Banking Fin SS V to reduce the time that goes into designing the presentation. This way, you can concentrate on the message while our designers take care of providing you with the right template for the situation. This slide shows graph and table which can be used by individual or investment banker to estimate the value of an enterprise by using its cashflow and multiplying it by discount rate.

4 Item(s)